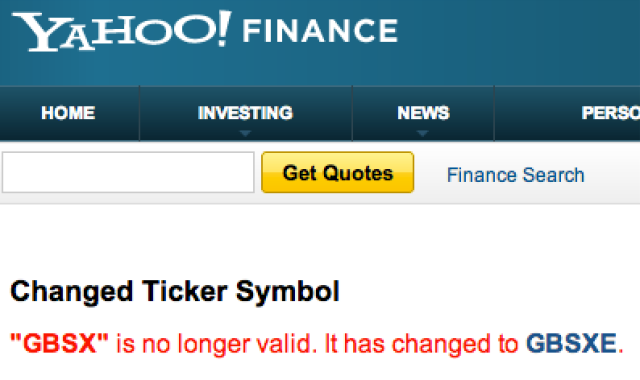

GBS + X + E = GBSXE

by Volker Weber

This is mandatory:

When a company that trades on the Nasdaq Stock Market or the Over-the-Counter Bulletin Board (OTCBB) falls behind in its reporting obligations with the SEC, the letter "E" is appended at the end of the company's stock ticker symbol.

What happens next?

on the OTCBB, after the "E" is added, the company is given a "grace period" to submit a complete report, typically 30 calendar days for U.S. companies and 60 calendar days for most U.S. banks and non-U.S. companies. If the company files complete required reports during the grace period, the "E" will be removed; if it does not, the company's stock symbol will be removed from trading on the OTCBB.

This (p.52) may or may not be related:

On April 9, 2012, the Company filed a Registration Statement on Form S-1 (File No: 333-180626) (the “Registration Statement”) therein registering the 6,044,000 shares of Common Stock underlying the Private Placement Warrants and 2,020,000 underlying the Investor Warrants on behalf of the selling stockholders named in the Registration Statement (the “Selling Stockholders”). As of the date of this Form 10-Q, the Registration Statement has not been declared effective under the Securities Act by the SEC. The Company is in the process of amending the Registration Statement in response to the SEC’s most recent comments regarding the first amendment to the Registration Statement filed on July 19, 2012.

Filings: read 10-Q for quarterly reports and 8-K for 20% interest rates. This started to smell funny 18 months ago:

We estimate the total market potential for the Transformer to be roughly $18.0 billion, of which we believe GBS's realizable market could be roughly $5.5 billion.

That market did not realize. The money spent developing and marketing Transformer did not pay off. And instead of trending from $4.25 to $9, the stock traded for $0.17 the day before Thanksgiving. That is minus 96 percent. $1,000,000 invested 18 months ago is now $40,000. If you can find a buyer.

Comments

Borrowing money from your subsidiary at 20% to make monthly payrolls... borrowing money from your subsidiary at 20% to pay bills... borrowing money from "an investor" at 20% against the companies you purchased... borrowing money from a director at 20% and securing it with your company assets with first rights against them in case of bankruptcy...

... oh, and your last quarterly report shows you have less than one million in liquid assets...

This doesn't end well for anyone...

It's all fun and games until somebody loses an eye. The interesting aspect is cash flow. It's that one bill you cannot pay, which breaks your back.

There probably is a billion dollar market to "modernize" these apps, but definitely not towards the platform that this Transformer service was targeting.

Very sad, especially for those that gave away their businesses to become part of GBS. All seemed strangely inevitable somehow...

Not to worry - there is still a good chance that Microsoft will buy them (if history is any indicator).

-Not to worry - there is still a good chance that Microsoft will buy them

Why ?

I would think the Transformer code still has value to another company, as it's the best product yet to reach into a Notes client app and prep it for another platform. Currently, transformer's platform of choice is Xpages, but I could see someone purchasing it with a different vision.

Thinking they were going to get $5.5 billion out of Transformer was insanity. Part of that high estimate is probably due to the rather high pricing of the tool itself.

sidenote: Nathan Freeman's blog, Escape Velocity, formerly hosted by GBS has gone dark (404). Mail to info@redpilldevelopment.com is rejected. That's really sad, since this group of people heve donated tremendous amounts of effort to the Domino community.

GBSXE is no longer valid. It has changed to GBSX.