Ballmer - a little numbers game

by Volker Weber

Interesting post on Business Insider:

Obviously Ray Ozzie gets this. Why doesn't Steve Ballmer?

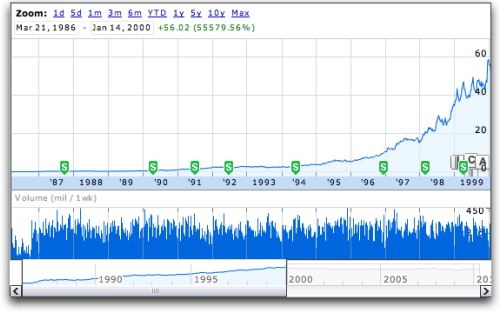

The most interesting performance metric of a CEO is the long term stock market, especially if you compare things. Let's start with Gates vs. Ballmer. This is Microsoft during the reign of Bill Gates:

And this is Microsoft during the reign of Steve Ballmer:

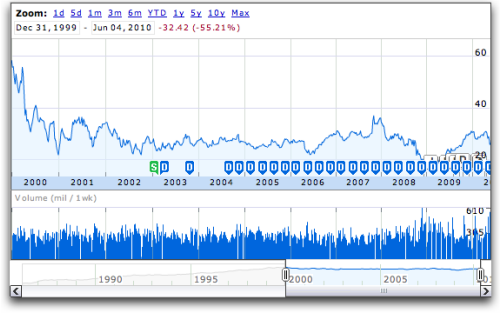

Yes, there is some bad luck at the beginning of his tenure, but after that, the stock stayed flat. Here is an interesting game: assume you had 20,000 invested in MSFT when Steve Jobs came back to Apple and you would have taken 10k out and invested them into AAPL:

During the first three years, the Gates years, you would not have done particularly well. But in the long run, you would have been fine. Your 10,000 MSFT would be 24,972 today, and your 10,000 AAPL would be a whopping 442,722, or a total of 467,694. That would have been much better than to keep your 20,000 MSFT, today worth 49,944.

Assume you did not trust Jobs to turn around Apple in 1997. But when the iPod was announced, you were smart. Let's do the same 10k split in 2001:

Your AAPL stock would be 284,261, and your MSFT stock 9,085, in total 293,346. Again much better than if you kept your MSFT stock, now worth 18,170.

Say, you did not trust the iPod, but when Ballmer dissed the iPhone, you started to realize he is often wrong, but never in doubt. We are again splitting 20k MSFT stock, investing half in AAPL:

Three years later, your AAPL stock is 30,453, your MSFT is 9,475, for a total of 39,928. This is almost double your investment, but betting on two horses. Of course you could have bet on AAPL and triple it, but that's not the game.

So you missed all three boats, but at the end of January, you finally caught up, when Jobs announced the iPad.

Your 10,000 invested in AAPL would now be 13,085, while your 10,000 in MSFT would be 8,879, or in total 21,964. That's a healthy +10% in half a year, instead of an 11% loss.

Comments

Like so many others, just wish I'd had the conviction to go buy that AAPL stock even three years ago. Amazing stats, thanks for sharing.

Hi! I'm a PC, and I'm buying Apple stock from the saved Apple tax ;-)

The one lesson from past bubbles certainly has been that one should buy shares ahead of the trend, or against a trend. And really, where can Apple shares go from here. Does Apple really have more potential than say Google? Does that might mean buying MS shares instead... naaahh just kidding :-)

Did not look in to it too much. But one question that came up. Was MSFT's stock price way more overhyped than AAPL's... in 1999? What were the underlying numbers like? Was Ballmer able to grow revenue and / or profit?

REDMOND, Wash. — July 19, 1999 - Microsoft Corp. today announced revenue of $19.75 billion for the fiscal year ended June 30, 1999,

a 29 percent increase over the $15.26 billion reported last year. Net income totaled $7.79 billion. source (important to point out 1999 was an amazing year for the economy with a huge IT hype and spending hype)

Redmond, Wash. – July 23, 2009 –

For the fiscal year ended June 30, 2009, Microsoft reported revenue of $58.44 billion, a 3% decline from the prior year. Operating income, net income and diluted earnings per share for the year were $20.36 billion,

Source (important to point out is that from July 2008 to July 2009 there was a very intense receission with IT spending being very low)

wenn das Wörtchen "wenn" nicht wär....;-)